- The S&P 500 closed above the 6,800 mark for the first time, joining the Dow and Nasdaq in setting new all-time highs.

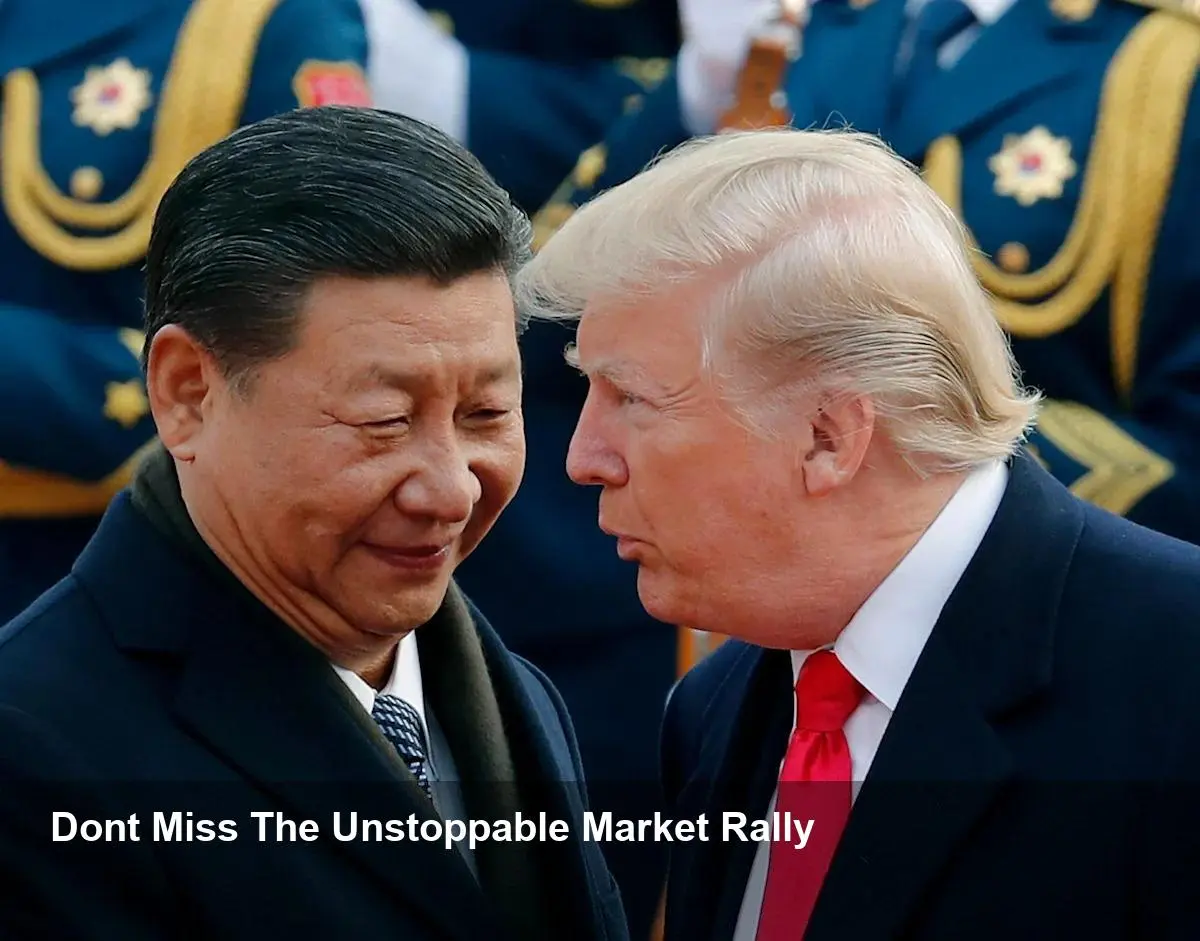

- Investor optimism is soaring due to promising signs of a breakthrough in the US-China trade standoff ahead of a key presidential meeting.

- A highly anticipated interest rate cut from the Federal Reserve and a crucial week of major tech earnings are also bolstering market confidence.

- The tech-heavy Nasdaq led the day’s gains with a powerful 1.9% jump, while the Dow Jones Industrial Average climbed over 300 points.

Wall Street Hits Record Highs on Trade Deal Optimism

U.S. stocks surged to unprecedented heights on Monday, with all three major indexes closing at fresh records. The rally was driven by a wave of optimism that a long-awaited trade deal between the United States and China could finally be within reach following President Trump’s upcoming meeting with Chinese President Xi Jinping.

The S&P 500 (^GSPC) was a standout performer, jumping more than 1.2% to close above the historic 6,800 level for the first time. It was joined by the Dow Jones Industrial Average (^DJI), which added over 300 points for a roughly 0.7% gain. However, the tech-centric Nasdaq Composite (^IXIC) led the charge, soaring 1.9% to also secure a new record close.

Confidence was buoyed by positive remarks from key officials. Treasury Secretary Scott Bessent told reporters he believes there is a “very successful framework” in place for the leaders’ discussion. Echoing this sentiment, President Trump stated, “I’ve got a lot of respect for President Xi, and I think we’re going to come away with a deal.”

A Pivotal Week for Markets

The upbeat mood on Wall Street is not solely based on trade hopes. Investors are gearing up for a pivotal week packed with market-moving events. The Federal Reserve is widely expected to announce an interest rate cut on Wednesday as it concludes its two-day policy meeting. This expectation was further cemented by a recent Consumer Price Index report showing cooler-than-expected inflation, strengthening the case for monetary easing.

Big Tech Earnings in Focus

Adding to the anticipation is a barrage of quarterly earnings reports from the “Magnificent Seven” tech behemoths. Microsoft (MSFT), Alphabet (GOOG), and Meta (META) are all scheduled to release their results on Wednesday, followed by Apple (AAPL) and Amazon (AMZN) a day later. The performance of these megacap companies will be a critical indicator of the tech sector’s health and could provide further fuel for the market’s record-setting run.

Individual Stock Movers

Beyond the broader index movements, several companies made significant headlines. Shares of Qualcomm (QCOM) soared nearly 20% after the company announced it was accelerating its push into the data center chip market, positioning itself to compete directly with giants like Nvidia (NVDA) and AMD (AMD).

Image Referance: https://finance.yahoo.com/news/live/stock-market-today-sp-500-crosses-6800-mark-joining-dow-nasdaq-in-fresh-records-as-us-china-trade-deal-hopes-run-high-200037582.html