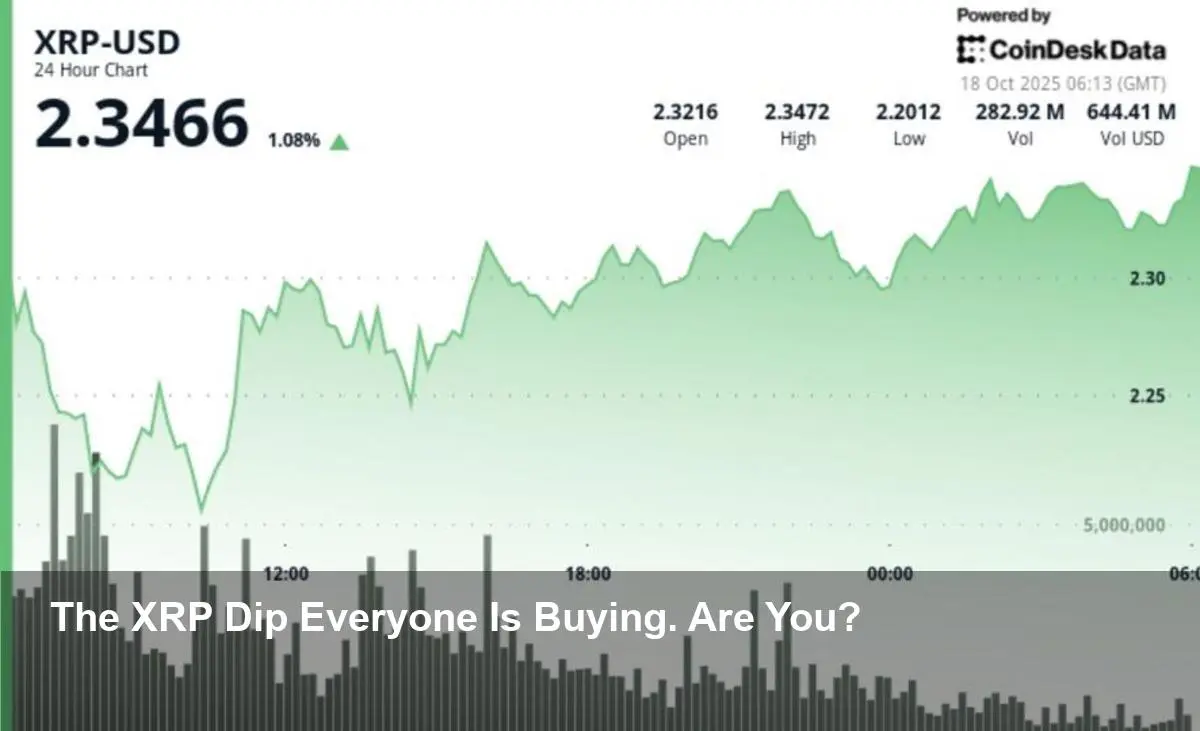

- Dramatic Rebound: XRP plunged to $2.19 amidst market-wide fears but was quickly bought up by large investors, stabilizing around the $2.33 mark.

- Explosive Volume: Trading volume surged to 246.7 million in a single hour, nearly tripling the 24-hour average and signaling a massive transfer from sellers to determined buyers.

- Looming Catalyst: All eyes are on the U.S. Securities and Exchange Commission (SEC), with deadlines for six spot XRP ETF applications approaching by October 25.

- Breakout Imminent?: Traders are watching the critical $2.40 resistance level, with a break above this point potentially triggering a significant rally.

XRP Withstands Market Shock, Bounces Back with Force

XRP demonstrated remarkable resilience on Friday, weathering a sharp, fear-driven sell-off that briefly dragged its price down to $2.19. The dip, fueled by renewed U.S.–China trade tensions and investor anxiety ahead of key regulatory deadlines, was short-lived as a wave of significant buying pressure absorbed the sales, pushing the asset back into a stable consolidation zone around $2.33.

Macro Fears Trigger Widespread Sell-Off

The initial downturn was not isolated to XRP. The broader cryptocurrency market felt the pressure, shedding 6% of its total market capitalization to land at $3.5 trillion. Investors across the digital asset space moved to reduce risk in response to macroeconomic uncertainty and the cautious positioning typical before a major regulatory announcement, such as the SEC’s impending decision on spot XRP Exchange-Traded Funds (ETFs).

Despite the market-wide panic, XRP’s price action told a story of underlying strength. The 7% intraday swing between $2.19 and $2.35 was characterized by a massive spike in trading volume, which peaked at 246.7 million during the 07:00 UTC hour. Analysts suggest this indicates a moment of “seller capitulation,” where panic-sellers were met by large, confident buyers accumulating positions at the lows.

Technical Levels and Trader Sentiment

With the price stabilizing, traders are now laser-focused on key technical markers that could dictate the next major move. The successful defense of the $2.23–$2.25 zone has established it as a critical support level, indicating a strong base of interest from buyers.

Key Price Points to Watch:

- Support: The $2.23–$2.25 area has proven to be a robust accumulation zone.

- Resistance: Immediate upside is capped by the $2.35–$2.38 band.

- The Breakout Target: A definitive move and hold above $2.40 is what bulls are waiting for as confirmation of a new upward trend, potentially targeting the $2.70–$3.00 range next.

The ETF Decision Looms Large

The primary catalyst on the horizon remains the SEC’s review of six pending spot XRP ETF filings, with a decision window running through October 25. An approval is widely expected to trigger a significant market repricing. Bolstering investor confidence is Ripple’s ongoing plan for a $1 billion treasury fundraising initiative, signaling strong institutional backing and long-term conviction. As the market consolidates, the tension between bearish macro sentiment and bullish catalysts has set the stage for a potentially explosive move.

Image Referance: https://www.coindesk.com/markets/2025/10/18/xrp-stabilizes-after-early-dip-traders-eye-usd2-40-breakout