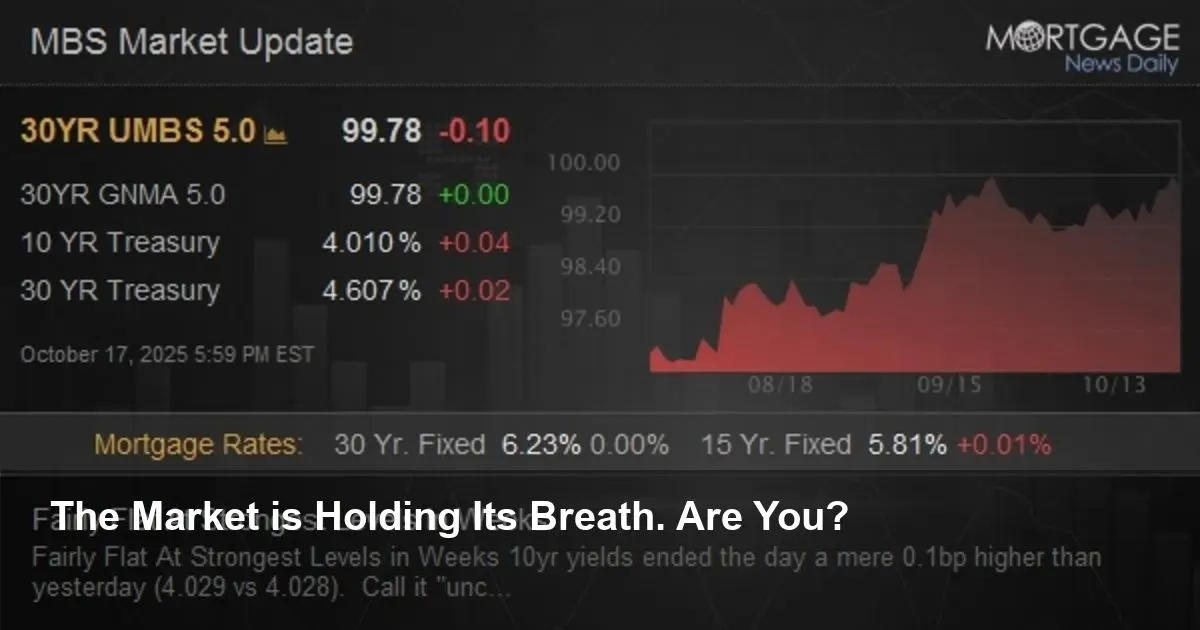

- Holding Steady: The 10-year Treasury yield ended the day virtually unchanged at 4.029%, maintaining its strongest position in four weeks.

- MBS Follows Suit: Mortgage-Backed Securities (MBS) also posted modest gains, settling at their highest levels in a month.

- Ignoring Data: Markets shrugged off a surprisingly strong NY Fed Manufacturing report, which would typically push yields higher, signaling underlying market conviction.

- Quiet Trading: Despite elevated volume compared to last week, the trading range was narrow and volatility was minimal, indicating a market consolidation phase.

Market Holds Strong at Four-Week Highs

The bond market demonstrated notable resilience as the 10-year Treasury yield held its ground, finishing the day almost completely flat. The benchmark yield ended at 4.029%, a mere 0.1 basis point higher than the previous day’s close of 4.028. This stability cements the yield at its most favorable level since September 17th, marking a significant four-week high for bond prices.

This strength was mirrored in the mortgage market, where Mortgage-Backed Securities (MBS) managed to add 2 basis points, also reaching their highest point in four weeks. While trading volume was lower than the preceding session, it remained elevated compared to most of last week, suggesting continued interest from investors even as the market entered a phase of consolidation.

A Day of Quiet Consolidation

After recent movements, Wednesday’s session was characterized by a distinct lack of volatility. The market remained within a narrow range, signaling that investors may be taking a pause to assess the new levels. This period of calm at multi-week highs suggests that the recent rally has found solid footing, with buyers and sellers reaching a temporary equilibrium.

Economic Signals Ignored?

Perhaps the most telling aspect of the day was the market’s muted reaction to a key economic report. The NY Fed Manufacturing index came in far hotter than anticipated, posting a reading of 10.7 against a forecast of -1.0. Typically, such a strong indicator of economic activity would pressure bond prices and send yields higher. However, the market largely ignored the data, a move that reinforces the current strength and conviction behind holding yields at these lower levels.

Mid-Day Volatility Shrugged Off

A minor bump in Treasury yields occurred mid-day, though it lacked a clear catalyst and failed to gain any real momentum. Some market analysts pointed to arcane speculation around funding market stress and liquidity conditions, but these theories were not substantiated by the timing of market events. The brief fluctuation was ultimately deemed insignificant, and the market quickly returned to its flat trajectory.

What This Means for Investors

The bond market’s ability to hold these gains, especially in the face of robust economic data, indicates a potential shift in sentiment. Investors appear comfortable at these yield levels, and the consolidation suggests a “wait-and-see” approach. The key question now is whether this is a temporary pause before the next major move or the beginning of a new, more stable range for interest rates.

Image Referance: https://www.mortgagenewsdaily.com/markets/mbs-recap-10152025