Highlights:

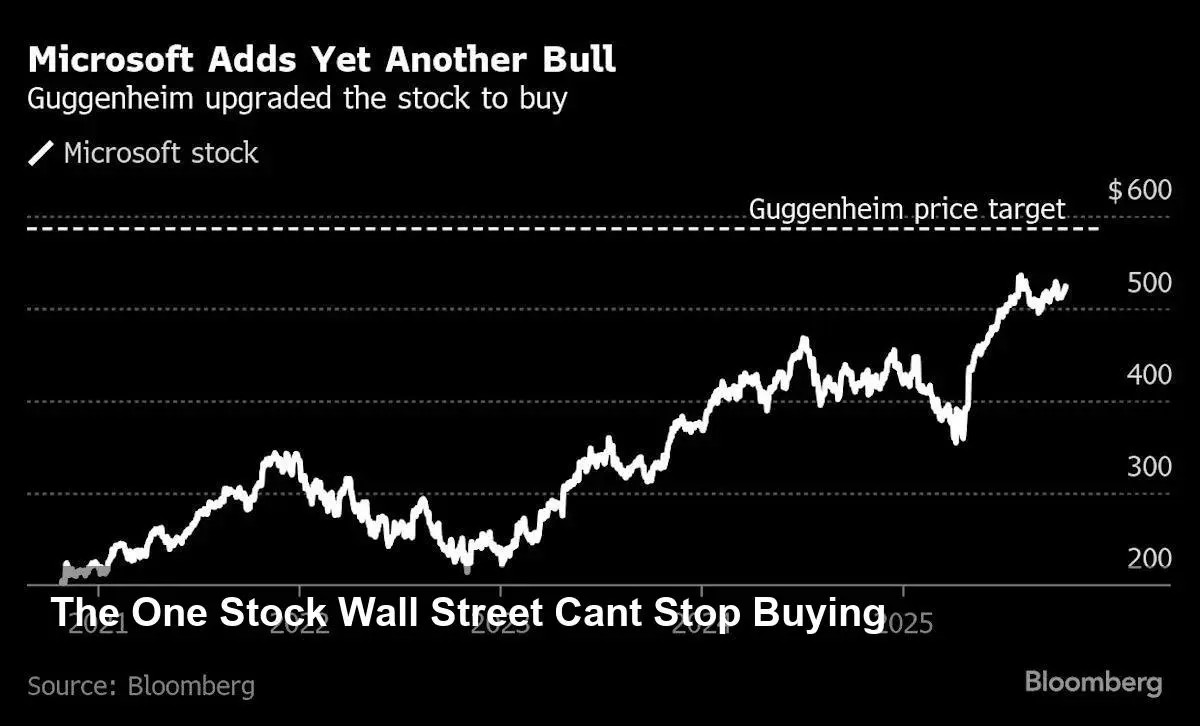

- Near-Unanimous Agreement: Following an upgrade from Guggenheim, nearly 99% of Wall Street analysts now recommend buying Microsoft stock.

- The Lone Holdout: Out of 73 analysts covering the company, 72 rate it a ‘buy,’ with only one neutral rating and zero ‘sell’ ratings.

- AI-Powered Growth: The bullish sentiment is overwhelmingly driven by Microsoft’s strategic position to capitalize on the artificial intelligence boom through its Azure and Copilot offerings.

- Strong Market Performance: The stock has already climbed 26% this year, outperforming the Nasdaq 100, and a new price target suggests an additional 12% upside.

Wall Street’s Unprecedented Consensus on Microsoft

In a rare display of near-universal agreement, Wall Street has solidified its bullish stance on Microsoft Corp. (MSFT). The conviction was further cemented after Guggenheim upgraded the software giant from ‘hold’ to ‘buy,’ tipping the scales to a point where an astonishing 99% of analysts tracked by Bloomberg now advocate for purchasing the stock.

Of the 73 analysts who follow Microsoft, a staggering 72 recommend it as a ‘buy.’ The single exception is Hedgeye Risk Management, which maintains a neutral rating. Notably, not a single analyst recommends selling the stock, underscoring the powerful confidence in the company’s trajectory ahead of its quarterly results.

The AI Engine Fueling the Optimism

The core of this widespread optimism lies in Microsoft’s commanding position in the artificial intelligence revolution. Guggenheim’s upgrade highlights this sentiment, with analyst John DiFucci stating, “in a time when investors struggle to separate AI beneficiaries from AI casualties, it’s clear to us that Microsoft, along with the other hyperscalers, is a beneficiary.”

This confidence is built on two primary pillars:

H3: Azure and Cloud Dominance

Microsoft’s Azure cloud computing business is seen as a primary recipient of major AI tailwinds. As companies increasingly integrate AI into their operations, the demand for robust cloud infrastructure skyrockets, placing Azure in a prime position for exponential growth.

H3: Direct Monetization with Copilot

Beyond infrastructure, Microsoft holds a significant advantage with its “near monopoly in the Productivity Suite market.” The integration of AI-powered tools like Copilot directly into its Office suite provides a clear and immediate path to monetize AI advancements, a strategy that few competitors can replicate at such a scale.

Market Momentum and Future Outlook

The market has already rewarded Microsoft for its strategic positioning. Shares recently rose 1.5%, marking a seventh consecutive positive session. Year-to-date, the stock has surged 26%, outpacing the Nasdaq 100 Index’s 22% gain.

With its upgrade, Guggenheim issued a price target of $586, implying a potential upside of about 12% from its last closing price. All eyes are now on Microsoft’s upcoming first-quarter results, where investors will be keenly watching for updates on AI-related growth trends and the company’s future spending plans to maintain its leadership in the space.

Image Referance: https://finance.yahoo.com/news/microsoft-upgrade-leaves-99-analysts-115109314.html